Turnover in BSE future and options index BANKEX and SENSEX derivatives contracts crossed over

₹10000 crores with an OI value of over ₹1350 crores.

Futures and options in BSE.

BSE is one of India’s premier stock exchanges that offers various financial instruments for investors and traders. Futures and options are derivative contracts for speculating on the future price movements of assets such as stocks, indices, commodities or currencies. The derivatives segment of BSE trades futures and options separately from the cash equities segment. The derivatives segment provides a platform for participants to engage in hedging, speculative and arbitrage activities. Futures contracts on the BSE represent an agreement to buy or sell an underlying asset at a certain price and date in the future. Options contracts, on the other hand, give the holder the right, but not the obligation, to buy and sell the underlying asset at a (strike price) within a specified time period.

Lot Sizes in BSE future and options.

BSE said that the lot size of Sensex future and options contracts have been reduced from 15 to 10 and the lot size of Bankex future and options contracts have been reduced to 15 from 20.

The statement said that the contracts would be generate from 12th May 2023 for S&P BSE Sensex [weekly, monthly and Long dated] and S&P BSE Bankex [weekly, monthly]. Since 15th May 2023 it would be available for trading.

How can you trade in Bse futures and options.

Account opening: The first step is that you must have a trading account with a broker or brokerage firm like zerodha, Upstox, Angel one etc. Keep in mind the broker should be authorize by BSE to trade on its derivatives segment.

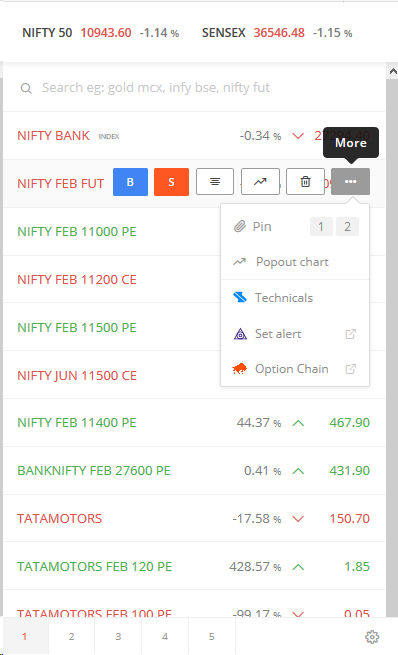

- Open your broker app.

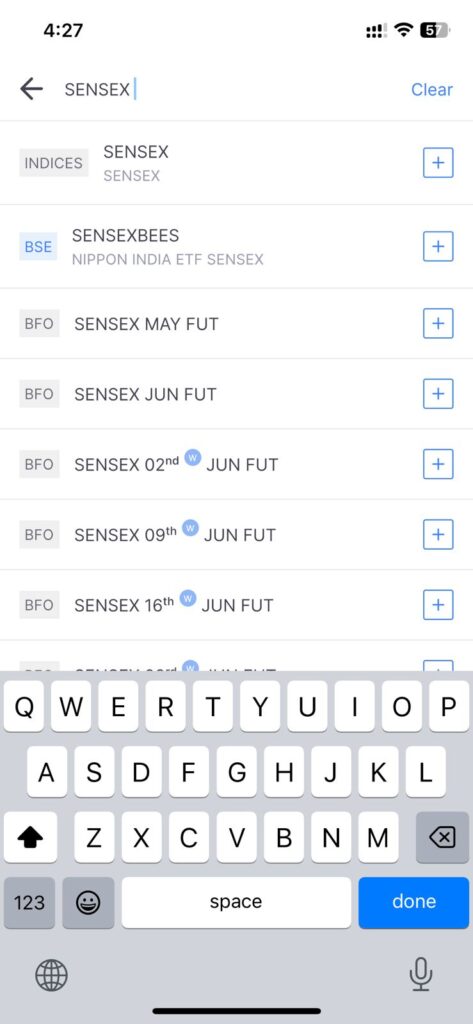

2. In the search tab type sensex.

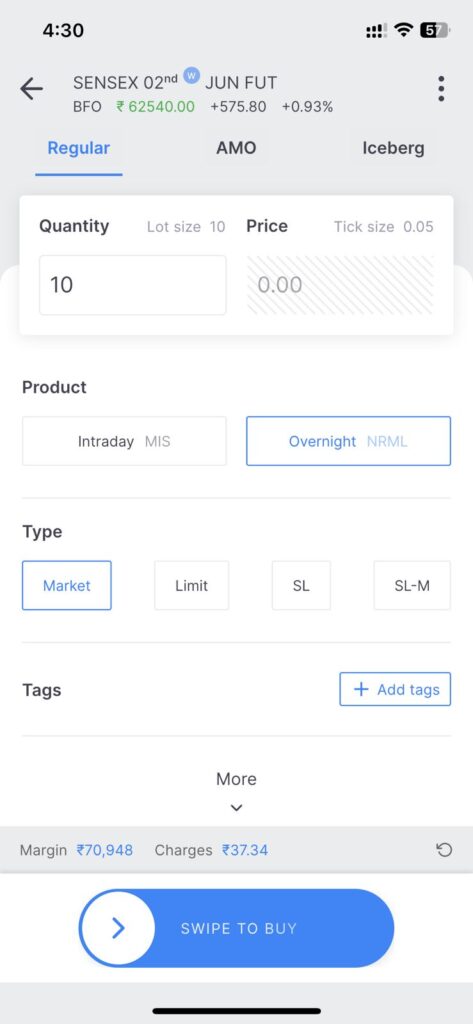

3. click on the futures contract you would like to buy.

4. Adjust the price and quantity according to your preference and then buy or sell.

Things to keep in mind when trading in BSE Futures and options.

Eligibility: Meet the eligibility criteria of BSE and broker to trade futures and options by fulfilling the necessary requirements. This includes owning a trading account, meeting KYC requirements and meeting margin obligations.

Product Understanding: Gain a thorough understanding of futures and options, including their contract specifications, trading hours, expiration dates, lot sizes, and tick sizes. Learn about terms such as spot price, strike price, premium, margin requirements and settlement procedures.

Risk Management: Develop a strategy for risk management to protect your capital. Set proper stop-loss orders to limit potential losses according to your risk tolerance. It is important to understand the risks involved in derivatives trading and never risk more than you can afford to lose.

Margin Requirements: Be aware of the initial margin, spread margin and exposure margin requirements specified by BSE and your broker. Make sure you have enough funds or collateral in your trading account to meet your margin obligations.

Position Limits: Follow the position limits set by the BSE. Position limits are set to determine the maximum number of futures or options contracts you can hold for a particular underlying asset. Violation of position limits may result in sanctions or other regulatory action.

Market Order and Limit Order: The prevailing market price executes a market order, while a limit order allows you to set a specific price to buy or sell a contract. Choose your order type based on your trading strategy and market conditions.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Intellect Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Intellect Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.