India’s GDP in Q4FY23 has grown by 6.1% from 4.4% in Q3, indicating a significant improvement in growth.

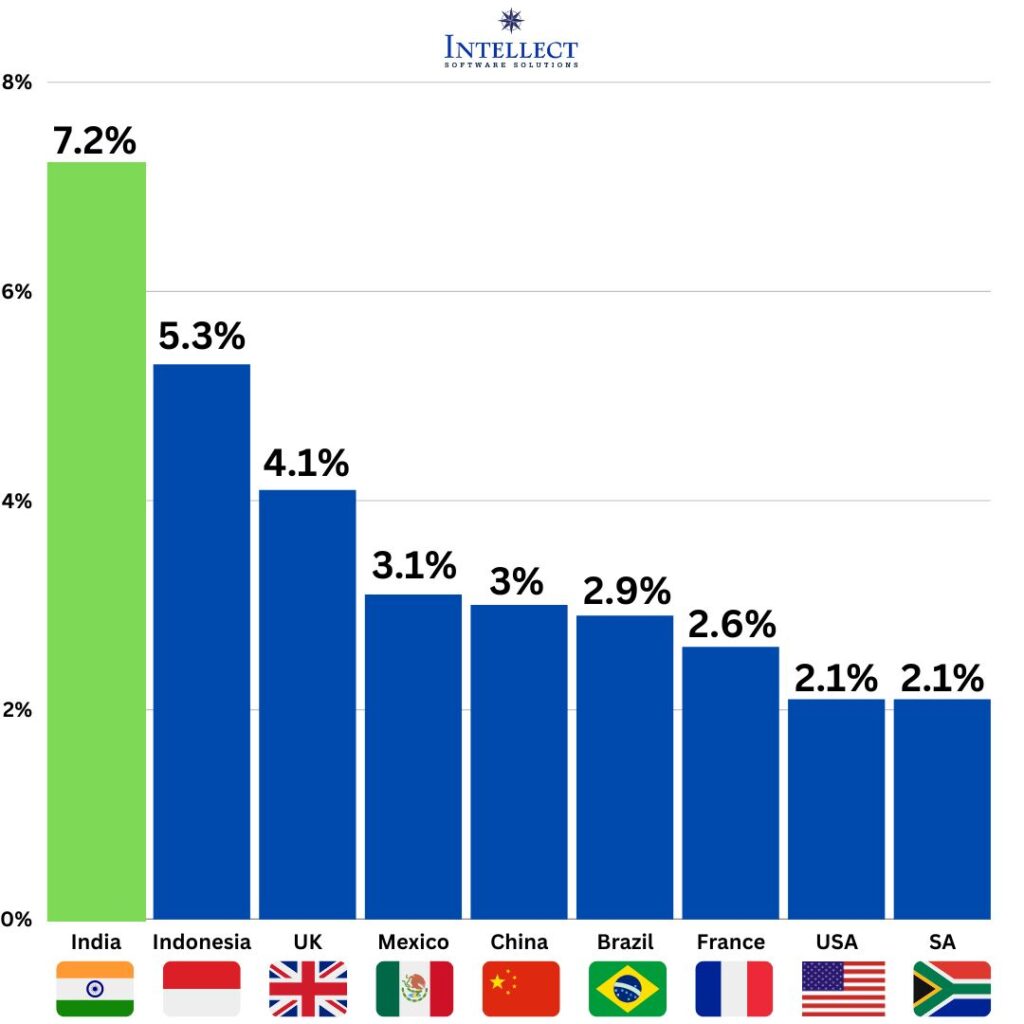

The Indian economy registered an impressive growth of 7.2% in FY22-23, benefiting from the positive trend seen throughout the year. These numbers beat expectations and indicate the country’s strong economic expansion during the period.

What is GDP?

(GDP) Gross domestic product is a widely use system that measures a country’s economic activity. It measures the total value of goods and services produced in a country over a period of time. GDP serves as a means of evaluating the size and growth of an economy.

Various methodologies are available to calculate GDP, the most common being the expenditure method. This method adds total consumption spending, investment, government spending, and net exports (exports minus imports). The income method combines individual and business income, including wages, profits, rents and interest, as an alternative approach.

What does latest GDP growth indicate for Indian stock markets?

In May, both the Sensex and Nifty 50 showed a positive performance with each index rising over 2%.

The Nifty has recently breached the range of 16,000-18,000 levels, indicating a breakout. These developments suggest that the market is going to make new highs in the second half of 2023. Broader markets have rebounded strongly from their October 2021 peak after an 18–20-month correction phase.

We are bullish on equity markets and expect the Indian economy to begin a multi-year growth cycle. Our confidence is based on an assessment of current conditions and a forecast of sustained economic growth in the coming years.

Central government finances outlook for FY24

The Government of India successfully achieved the fiscal deficit target of 6.4% of GDP in FY23. This achievement is supported by strong gross tax collection and focus on capital expenditure (capex), which emerged as the main highlights of the government’s fiscal performance during the year. Save Report

It is expect that gross tax revenue growth may experience some moderation due to the lower growth rate of nominal GDP. However, there are positive developments on the non-tax revenue front as the Reserve Bank of India (RBI) transferred ₹ 87,416 crore compared to ₹ 30,307 crores in the previous fiscal.

In addition, the dividend payout from the RBI alone exceeded the budgeted amount of ₹48,000 crore, considering the contributions from the RBI, nationalized banks and financial institutions combined. This is expected to support government finances in the current fiscal year, especially in view of slower disinvestment receipts Save Report

What were the surprise elements in GDP Q4 FY23 growth?

Fourth quarter GDP data for India is a pleasant surprise, showing a growth rate of 6.1%. This indicates a strong recovery in the Indian economy that is going against expectations and macro challenges. The momentum has picked up significantly and a wide-ranging recovery is seen in various sectors, including manufacturing, mining, construction and agriculture.

Agriculture and farming emerged as the surprise elements of the economic recovery, while manufacturing growth was relatively stable and in line with expectations. Overall, there is a recovery in economic activity drive by strong government investment. However, the consumer side of the economy has yet to catch up, which remains a challenge.

The main contributor in current economic recovery is largely capital expenditure (capex), and this focus on investment-led growth has helped keep the Indian economy afloat compared to other major global economies.

As a result, there are expectations of positive market performance and potential revisions by the Reserve Bank of India (RBI) in its upcoming policy meetings to further support the economy.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Intellect Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Intellect Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.