Revolutionizing the Finance Industry with AI Based Algo Trading

With Algorithmic Trading | Where Precision Meets Profitability!

Are you ready to revolutionize your trading strategy? Algo Engine is not just a tool; it's your key to unlocking a new realm of trading possibilities. Seamlessly designed for optimizing trade execution, ensuring precision, and minimizing market impact costs, Algo Engine is here to elevate your trading experience to unprecedented heights.

- Time Weighted Average Price (TWAP) - Order Slicing

- Time Weighted Average Price (TWAP) – Price Band

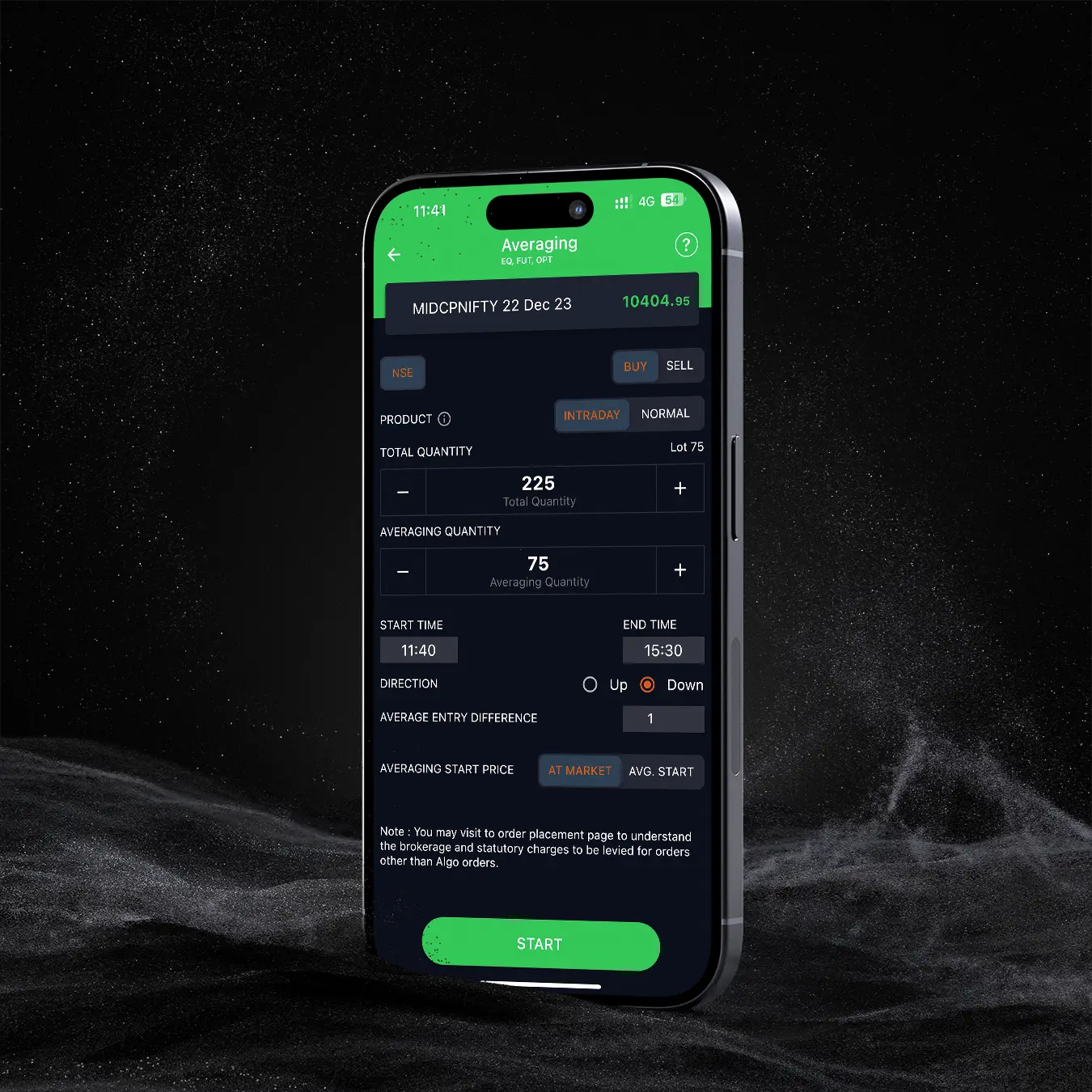

- Averaging Scalper Algo

- VWAP Scalper Algo

- Averaging Price Betterment Algo