One of the most popular technical analysis patterns is Cup & handle pattern. It is mostly use in trading stocks, commodities, currencies etc.

What is Cup & Handle pattern?

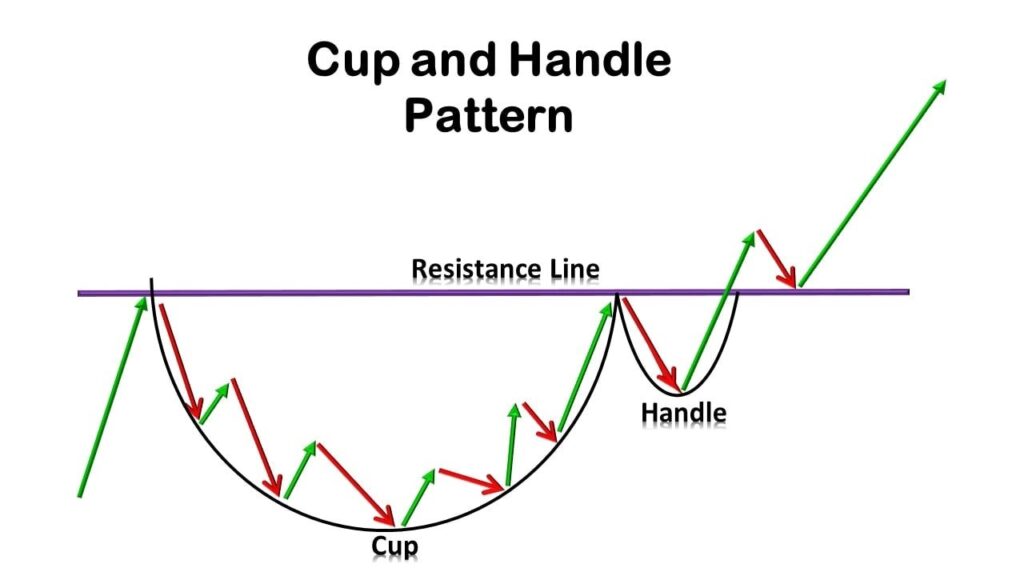

Its name comes from its shape, which resembles a cup with a small handle. This pattern usually begins with a rounded bottom forming a cup, followed by a short period of consolidation to form a handle.

Traders interpret this pattern as a bullish signal, indicating a potential continuation of the uptrend. The validity of the pattern is confirm when the stock price breaks above the handle.

However, traders should not only rely on technical analysis, but also consider fundamental analysis, market sentiment and risk management before making a trading decision.

How to use it.

- Identify the pattern: Look for a rounded bottom formation followed by a short period of consolidation forming a handle. The cup and handle should be symmetrical, and the handle should be relatively short.

- Judge its strength: Check the depth of the cup and the length and angle of the handle. A deeper cup and slower handle are stronger indicators of an upcoming bull trend.

- Confirm the pattern: Wait for the stock price to break above the handle on significant trading volume. This distribution confirms the validity of the pattern.

- Execute the trading strategy: Once the pattern is confirm, consider entering a long position and placing a stop-loss order below the minimum of the handle.

- Traders can also use technical indicators such as moving averages and oscillators to confirm the strength of a pattern and execute their trading strategy.

It is important to remember that the Cup and Handle pattern is not always a reliable indicator of future price movements and traders should use it in combination with other technical and fundamental analysis tools to make informed trading decisions. Proper risk management and position sizing are also critical to managing potential losses.

Placing Stops and Taking Profits.

Placing stops losses and booking profits in the Cup and Handle pattern is essential to trade management and risk management. Here are some general guidelines to consider when setting your stops and profit targets:

Stop loss:

Traders should enter a stop-loss order below the handle level to limit potential losses if the stock price falls below this level. If the price falls below this point, it could indicate that the pattern is invalid and that the stock is likely to continue to move down.

Take profit:

Traders can set a profit target by projecting the height of the cup and adding it to the breakeven point. Alternatively, they can use a trailing stop or a dynamic price target, such as the next major resistance level, to gradually take profits as the share price rises.

Cup & Handle pattern on ICICI Daily chart

ICICI Bank shows a potential Cup & Handle chart pattern in its daily chart. However, traders should always confirm the pattern before entering a trade and implement appropriate risk management to mitigate potential losses.

Check out our other blogs.

Disclaimer: The information provided in this Blog is for educational purposes only and should not be construed as financial advice. Trading in the stock market involves a significant level of risk and can result in both profits and losses. Intellect Software & Team does not guarantee any specific outcome or profit from the use of the information provided in this Blog. It is the sole responsibility of the viewer to evaluate their own financial situation and to make their own decisions regarding any investments or trading strategies based on their individual financial goals, risk tolerance, and investment objectives. Intellect Software & Team shall not be liable for any loss or damage, including without limitation any indirect, special, incidental or consequential loss or damage, arising from or in connection with the use of this blog or any information contained herein.