NSE Empanelled Vendor

We are proud to announce that Intellect Softwares is now an empanelled vendor of NSE.

Who We Are

Empowering Stock Market Brokers with Trading Apps and Solutions.

Trusted by Top Financial Institutions, Brokers & Traders.

-

About Us

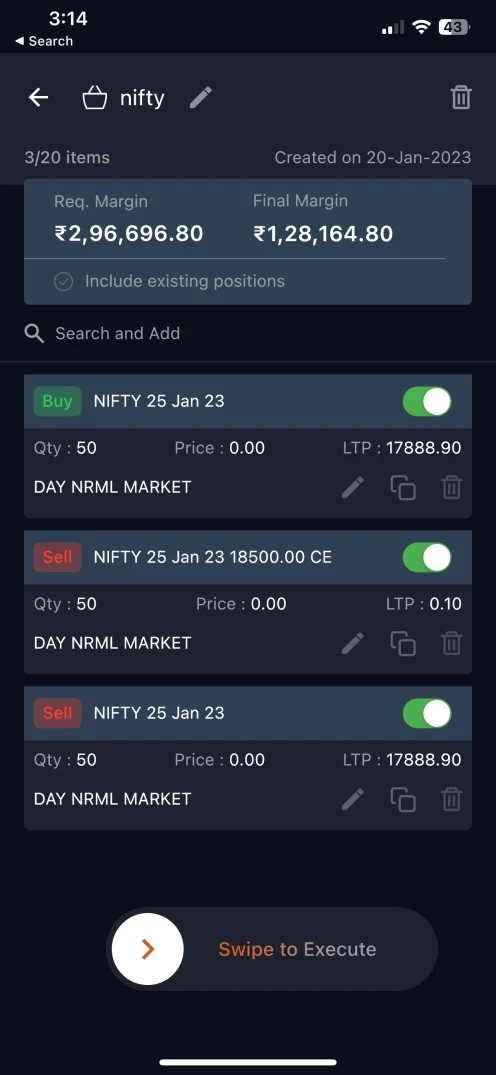

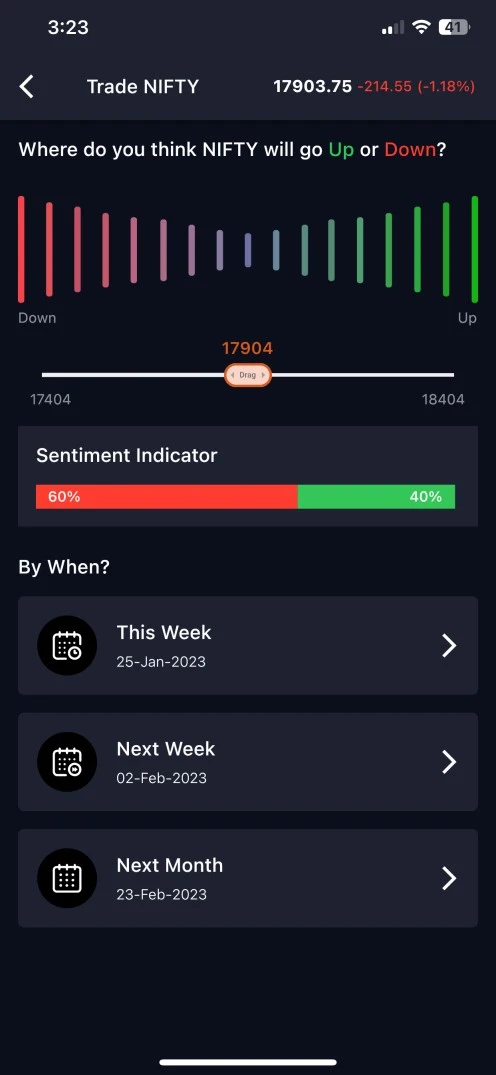

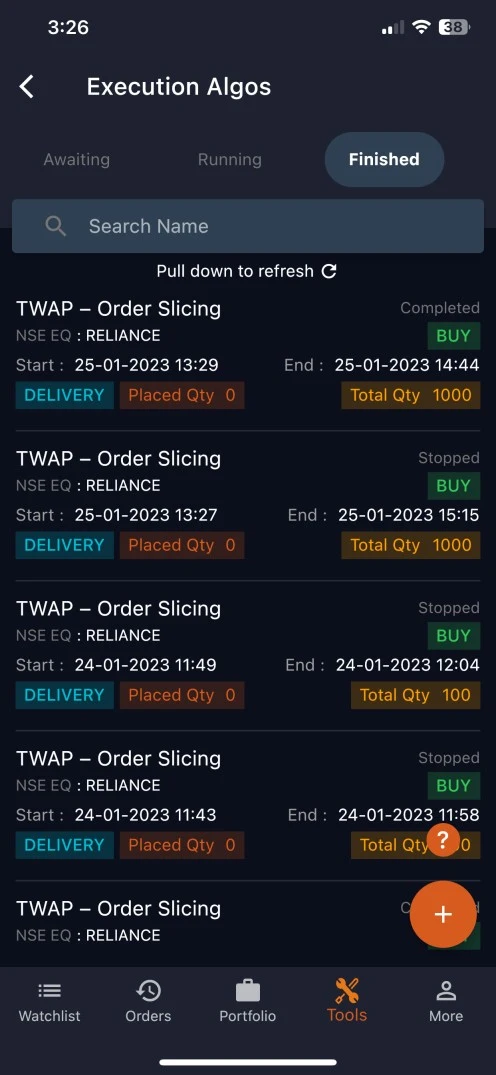

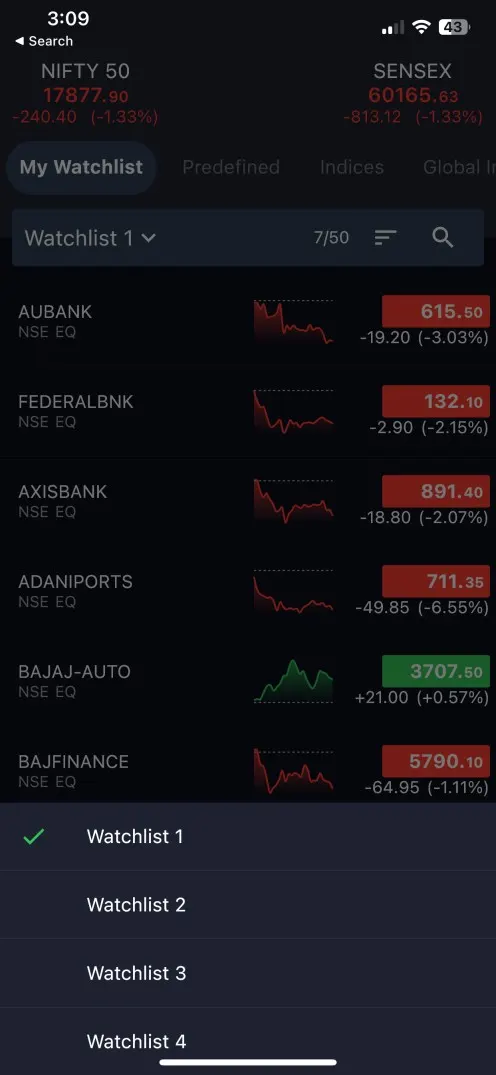

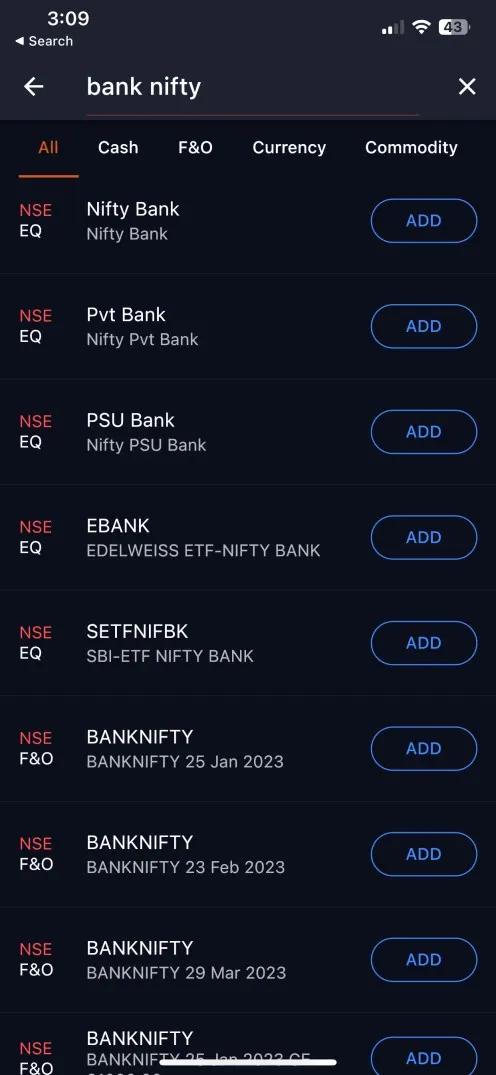

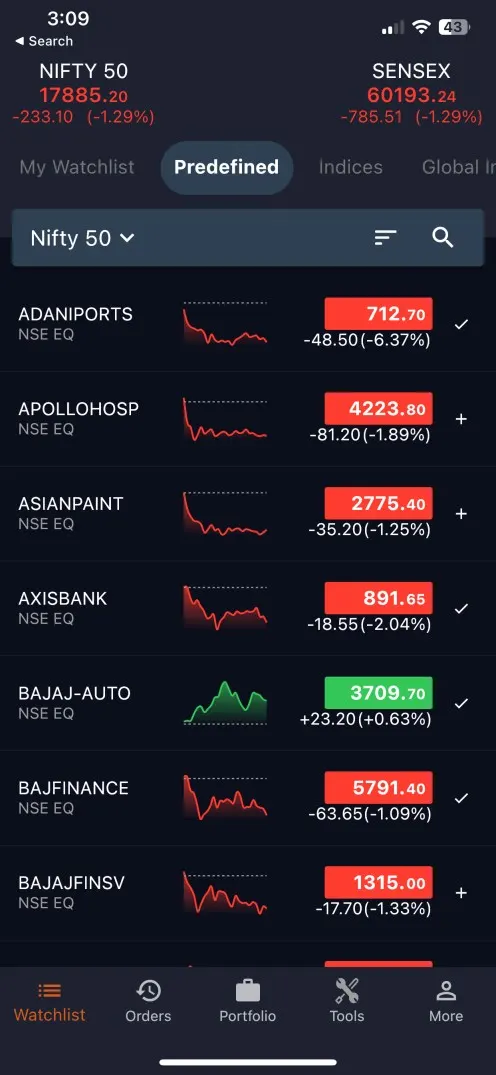

Providing Advance Trading Mobile Apps and Solutions to the stock market brokers around the globe. We lead the way with our pioneering services: Trading App, order management, risk management, algo software, web charts, small cases, and middleware technology. Unleash your potential with our industry-leading solutions.

-

Our Vision

At Intellect we remain committed to creating a dynamic & most innovative trading platforms that equips users with all the necessary tools for their trading activities. In a rapidly-changing and ever-expanding industry, we continuously refine our services to cater to the needs of traders worldwide.

20

Years

of experience